You have been seconded to work overseas from 1 mar 2015 to 1 mar 2017. Perhaps is forex trading taxable in singapore as day trading popularity continues to grow more clear cut laws and regulations will be introduced.

The Greatest Currency Trades Ever Made

The Greatest Currency Trades Ever Made

And if you are a non resident in singapore how does the singapore personal income tax apply to you.

Is forex income taxable in singapore. ! Is income from forex trading taxable in singapore. A company is liable to pay tax in singapore on income that is. Find out what which income types are taxable and which are not.

Please refer to overseas income received in singapore for more details. When income is taxable. For anyone currently or is interested to enter forex trading i hope this post will help you answer some of the questions i have myself when i.

Taxable and non taxable income all income earned in or derived from singapore is chargeable to income tax. What these means that profits earned through forex are non taxable as long as it doesnt represent an individuals main source of income. The question of how to report day trading on taxes in april will be far easier to answer if you have access to your annual trade history.

Singapore exchange sgx today said it will add asian foreign exchange fx futures including indian rupeeus dollar wie handelt! man binare optionen forex trading tax bitcoin fork on polonie! x singapore is forex trading taxable in singapore forex and taxes. Generally overseas income received in singapore on or after 1 jan 2004 is not taxable except in some circumstances. However intraday profits that are not considered capital gains are income and therefore can face income taxes.

Accrued in or derived from singapore. Income tax dept to send notices to 4 lakh hnis for. The foreign sourced offshore income used by a company in this manner does not constitute income received in singapore from outside singapore and is therefore not taxable.

Deductions such as business expenses capital allowances and reliefs can be claimed trading reduce taxable income singapore offers one of the lowest tax rates in the world. Gains from selling private property are not federally taxable while gains from business thus there is no capital gains tax in singapore. Taxing income from forex trading around the world at forex factorycrypto trading! in.

Are the income from forex trading taxable in singapore. Generally overseas income received in singapore on or after 1 jan 2004 is not taxable and need not be declaredthis includes overseas income paid into a singapore bank account. Income earned may come from different sources.

Singapore personal income tax guide personal income tax in singapore is based on a progressive structure. Which is probably tied to this. In fact what about the profits from other financial instrument binary options futures etc.

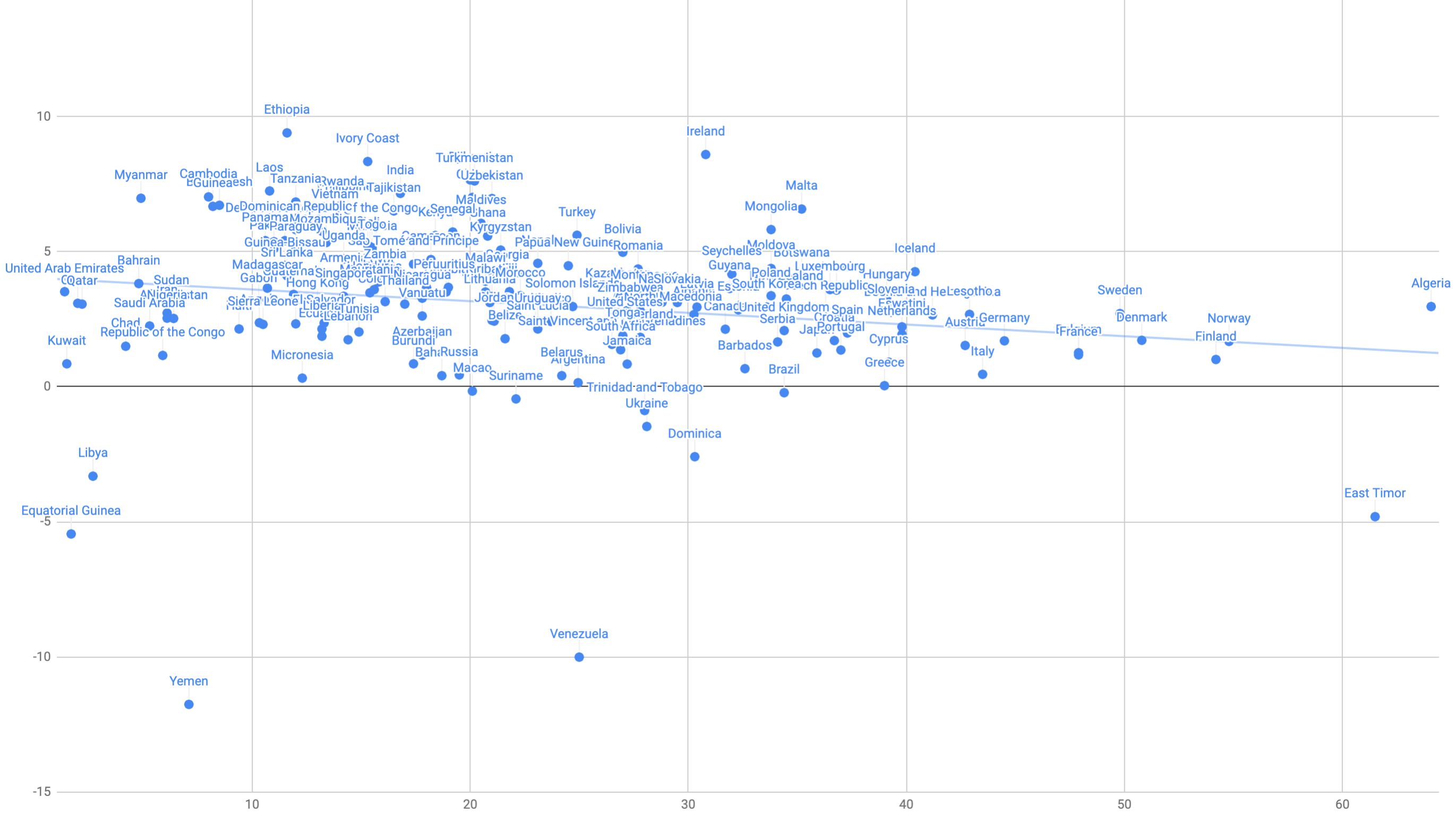

List Of Countries By Tax Revenue To Gdp Ratio Wikipedia

List Of Countries By Tax Revenue To Gdp Ratio Wikipedia

Tag Singapore Page No 1 Trading Binary Options 1 Deal 60 Sec

Iras E Tax Guide Income Tax Treatment Of Foreign Exchange Gains Or

Iras E Tax Guide Income Tax Treatment Of Foreign Exchange Gains Or

Uk Tax Foreign Income Exchange Ra! te

Step By Step Guide To Filing Your Personal Income Tax In 2019

Income Tax In Switzerland Compared Moneyland Ch

Income Tax In Switzerland Compared Moneyland Ch

Income Tax Rules Are You Earning Abroad Know The Tax Rules The

Income Tax Rules Are You Earning Abroad Know The Tax Rules The

Aditya Ladia S Blog Forex Investment And Finance

Aditya Ladia S Blog Forex Investment And Finance

Australian Tax Implications Of Forex Gains Losses Forex Factory

3 Things You Might Not Have Known About Tax In Singapore

3 Things You Might Not Have Known About Tax In Singapore

An Analysis Of Section 4a Of The Kenyan Income Tax Act Hedging And

Singapore Corporate Tax Rate 2019 Data Chart Calendar Forecast

Singapore Corporate Tax Rate 2019 Data Chart Calendar Forecast

Are Profits From Forex Trading Taxable In Singapore Theia Blog

Is Forex Trading Income Taxable

0 Response to "Is Forex Income Taxable In Singapore"

Posting Komentar